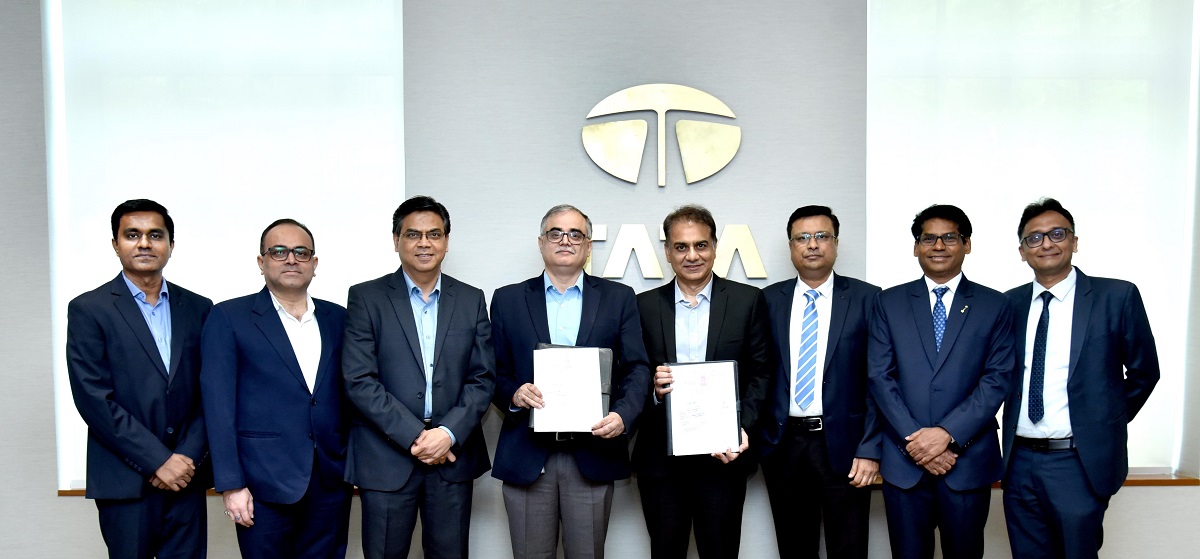

Tata Motors has forged a strategic alliance with Bajaj Finance Ltd., a prominent entity under Bajaj Finserv Ltd., to enhance access to financing solutions across its extensive commercial vehicle portfolio. The collaboration, marked by a Memorandum of Understanding (MoU), aims to leverage Bajaj Finance’s robust financial services infrastructure to benefit entrepreneurs and businesses in the transportation sector.Under the agreement, Bajaj Finance will extend its offerings, including flexible loan options, competitive interest rates, and digitally-enabled processing, ensuring ease and convenience for Tata Motors’ customers nationwide. This partnership marks Bajaj Finance’s debut into commercial vehicle financing, tapping into the sector’s vast potential with a tailored approach to meet diverse customer needs.

Commenting on the collaboration, Mr. Rajesh Kaul, Vice President & Business Head – Trucks, Tata Motors Commercial Vehicles, expressed enthusiasm, stating, “We are delighted to partner with Bajaj Finance, aligning with our commitment to deliver superior solutions for customer satisfaction. This initiative will empower entrepreneurs across India, leveraging Bajaj Finance’s extensive urban and rural network to provide accessible financing solutions.”Anup Saha, Deputy Managing Director of Bajaj Finance, highlighted the customer-centric approach, affirming, “Our collaboration with Tata Motors underscores our dedication to enhancing the ownership experience through seamless financing solutions. Utilizing our advanced India stack-based processes, we aim to simplify commercial vehicle purchases and support more owners in realizing their business ambitions.”

Tata Motors offers a comprehensive range of commercial vehicles catering to various segments, from sub 1-tonne cargo vehicles to 55-tonne trucks and buses, ensuring quality and service excellence through a widespread network of over 2500 touchpoints across India. Bajaj Finance, with assets under management of ₹3,30,615 crore and serving millions of customers, continues to expand its footprint across lending, deposits, and payments, reinforcing its position as a diversified financial powerhouse committed to driving economic growth and customer satisfaction.