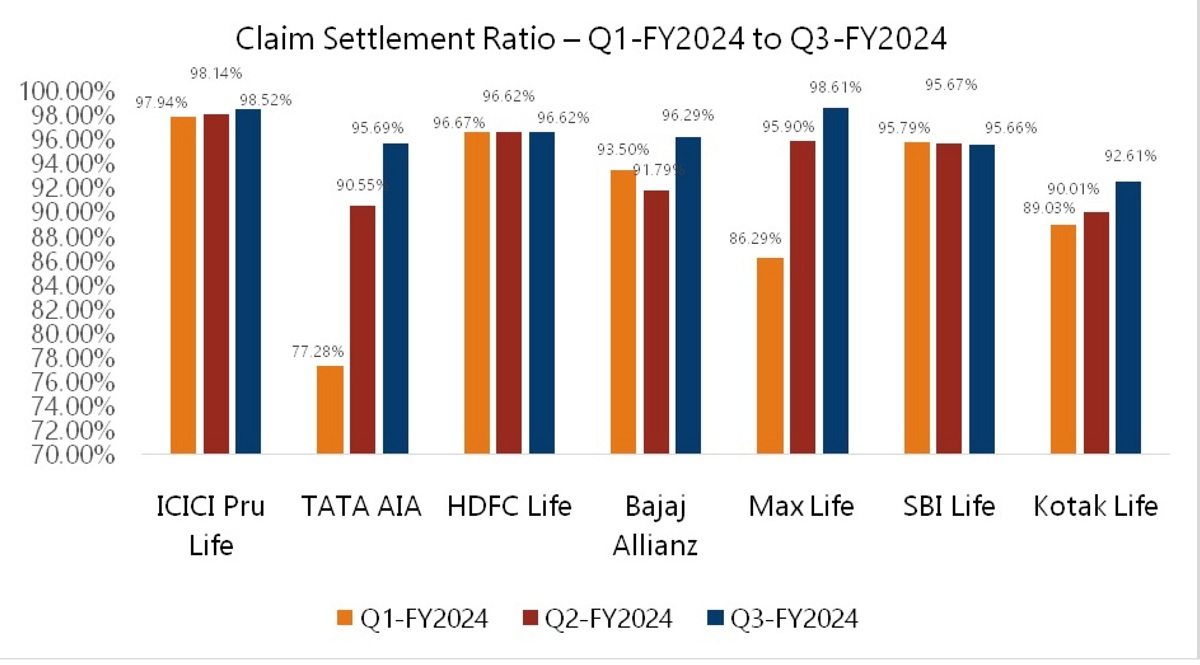

ICICI Prudential Life Insurance has a consistent claim settlement ratio, with a 98.6% ratio for the first nine months of FY2024. This ratio provides peace of mind for policyholders, as it ensures their family is not financially vulnerable. The company’s claim settlement ratio in Q1-FY2024 was 98.10%, Q2-FY2024 was 98.14%, and Q3-FY2024 was 98.52%. The average claim settlement turnaround time for non-investigated claims was only 1.3 days for the nine months ended December 2023.

For the first nine months of this fiscal year, ICICI Prudential Life settled 3,070 claims under ‘Claim For Sure’, amounting to Rs 214.70 crore. Most claims are electronically settled, ensuring immediate access to claim proceeds. Life insurance is an essential component of financial planning, providing financial security to the family and/or dependents.

Life insurance is an essential component of financial planning, providing financial security to the family and dependents. ICICI Prudential Life offers a ‘Claim For Sure’ service, which settles eligible death claims in one day after receiving all documents. If a claim is delayed, the beneficiary is compensated with interest accrued on the claim amount. The company also offers home pick-up of claim-related documents and digital touchpoints for claim lodgement and tracking.